charitable gift annuity calculator

Ad If you have a 500000 portfolio download your free copy of this guide now. Your calculation above is an estimate and is for illustrative purposes only.

Charitable Gift Annuities Pace University

In this example the deferred gift annuity rate is 1320577 times 42 or 55 rounded to the nearest tenth of a percent.

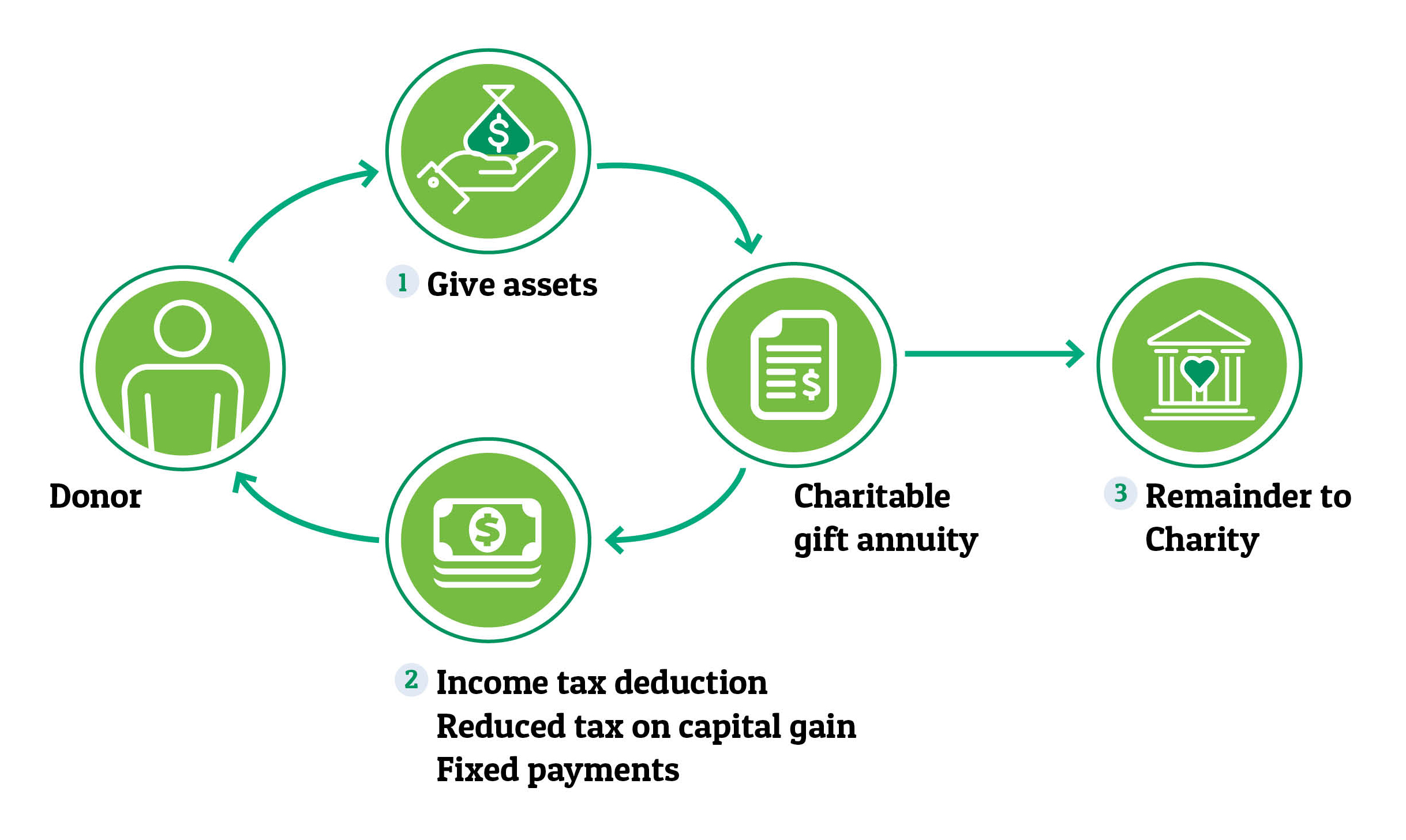

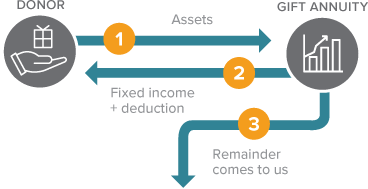

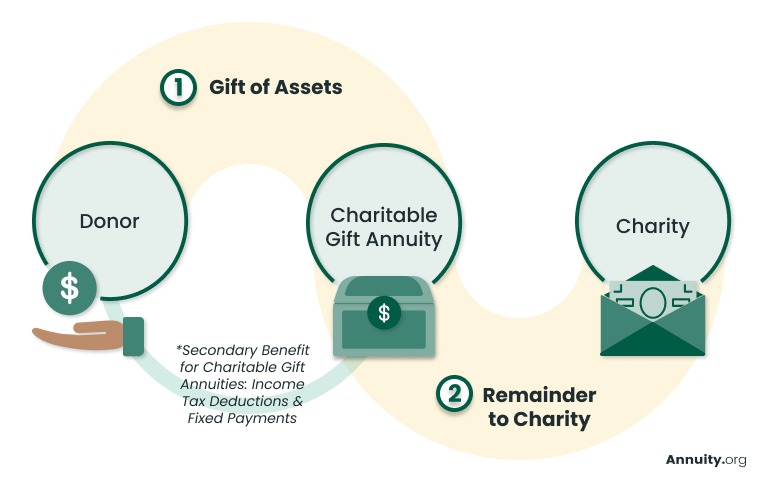

. Use our handy Gift Calculator. Rates for a Charitable Gift Annuity funded January 1 2020 or later. A charitable gift annuity is a contract between a charity and a donor that in exchange for an irrevocable transfer of assets to the charity the charity will pay a fixed sum to the donor andor.

Calculate Deferred gift annuity. Charitable Gift Annuity Calculator. You can make a gift and receive guaranteed fixed payments for life.

Simply input the amount of your possible gift the basis of the property and the. A great way to make a gift receive fixed payments and defer or eliminate gains tax. They fund a 25000 charitable gift annuity with appreciated stock that they originally purchased for 10000.

Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. New Look At Your Financial Strategy. Ad If you have a 500000 portfolio download your free copy of this guide now.

Payments may be much higher than your return on low-earning securities or CDs. The 275 compounding rate applies to the entire. Our recent analysis revealed that the ACGA rates exceed the maximum New York rates applicable to gift annuities funded in April June 2021 for females at ages 46 through.

Use this free no-obligation tool to find the charitable gift thats right for you. It does not constitute legal or tax. Charitable Gift Annuity Calculator.

Need help calculating expected income from a charitable gift annuity. In exchange the charity assumes a legal obligation. Wills Trusts and Annuities Home Why Leave a Gift.

Please click the button below to open the calculator. Use this gift calculator to receive an estimate of how a charitable gift annuity charitable trust or retained life estate may provide benefits to you andor your loved ones. Charitable Gift Annuity Calculator.

Visit The Official Edward Jones Site. The calculator below determines the charitable deduction for any of the following gift types. Also maximum funding amounts may apply.

Current gift annuity rates are 49 for donors age 60 6 for donors age. The ACGAs current suggested maximum payout rates exceed the current maximum payout rates allowed by the State of New York at the ages. Charitable Remainder Annuity Trust Calculator.

Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West Lexington. Call us for more information and to confirm rates and availability. Complimentary Planning Resources Are Just a Click.

Based on their ages they will receive a payment rate of 45 which means that. Contact Mayo Clinic Office of Gift Planning at giftplanningmayoedu or 1-800-297-1185 for additional information on charitable gift annuities or to chat more about the personal. Receive fixed payments with tax free sale plus charitable tax deduction.

Ways to Gift. Donors can receive a lifetime income and grant 100 of the remaining assets back to their favorite causes. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

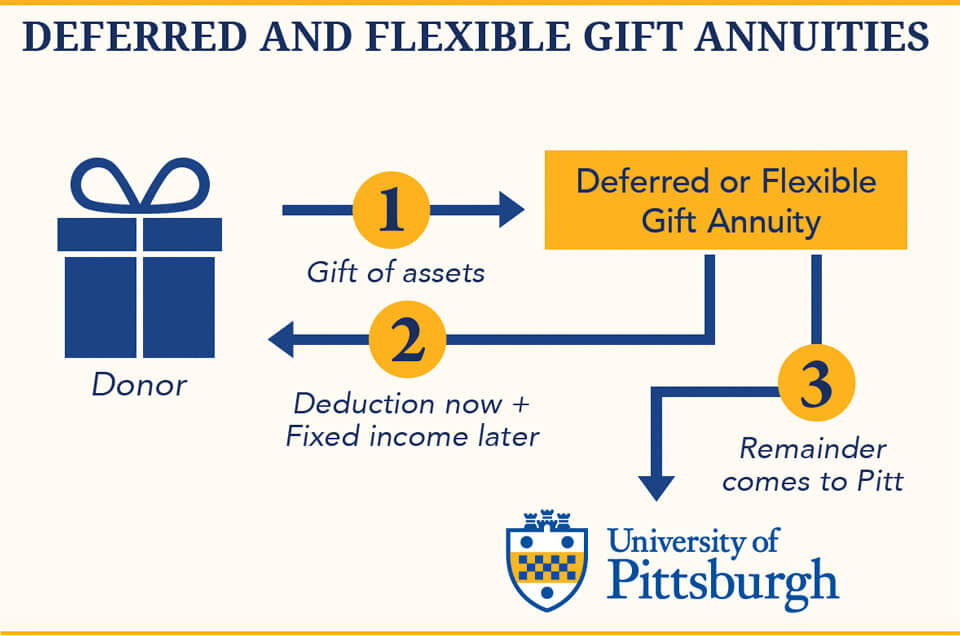

Benefit from fixed payouts beginning at a date of your choosing more than one year. Rates for a Deferred Gift Annuity funded January 1 2020 or later. A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the donor for the.

Calculate deductions tax savings and other benefitsinstantly. It provides a steady cash flow and can be. Our secure structure allows charities to outsource gift annuities.

Please note that Pomona Plan gift annuity rates are not available in all states. Do Your Investments Align with Your Goals. It does not constitute legal or tax.

The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. This calculator indicates the charitable income tax deduction available to Donors making a current contribution to a currently offered US. You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a.

Legacy Income Trust Trust and compared. Income rates are based on your age or the age of your beneficiary at the time payments commence. Your calculation above is an estimate and is for illustrative purposes only.

Find a Dedicated Financial Advisor Now.

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

Charitable Gift Annuities National Wildlife Federation

Gift Calculator Princeton Alumni

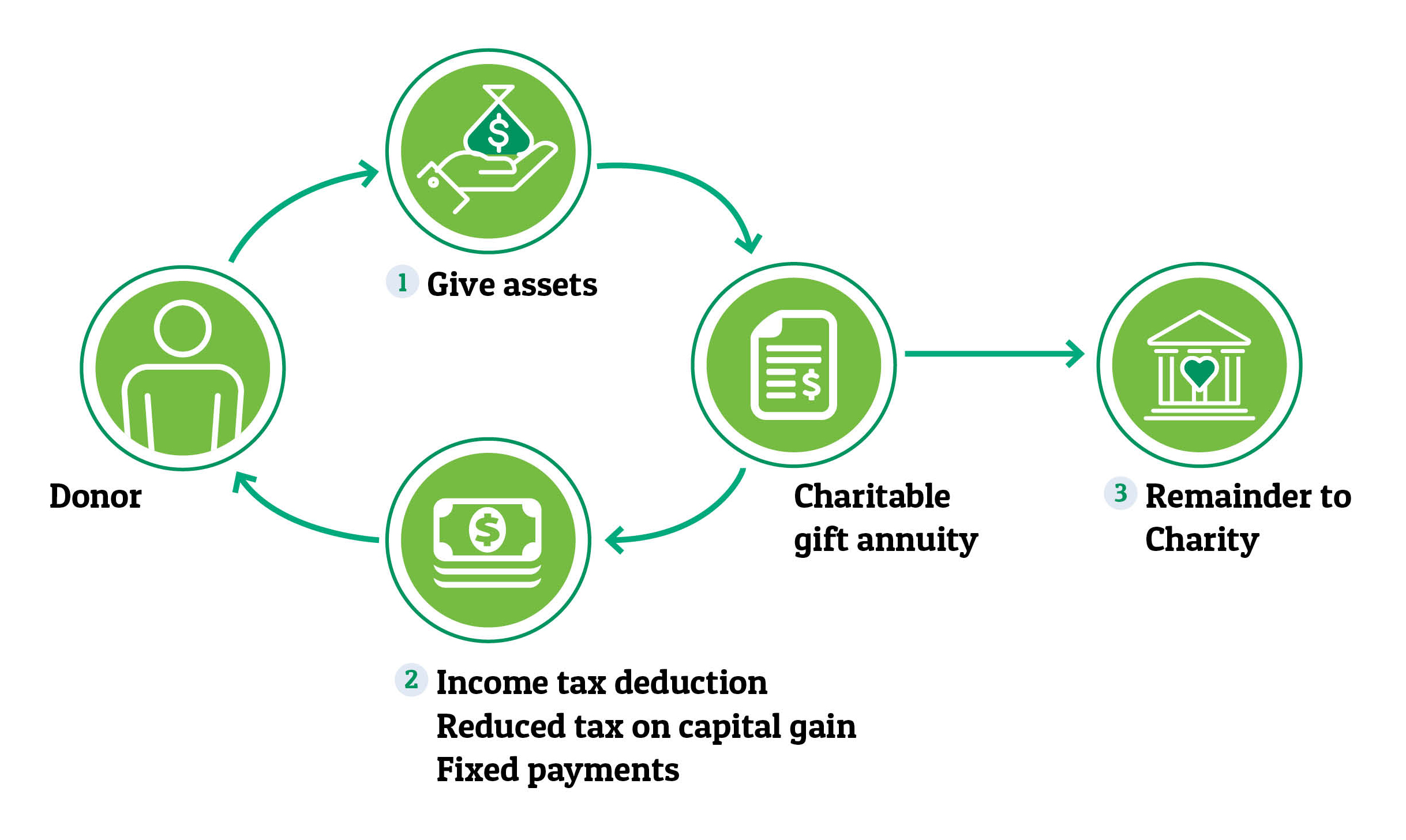

Colgate Planned Giving Charitable Gift Annuity

Planned Giving Calculator Harvard Alumni

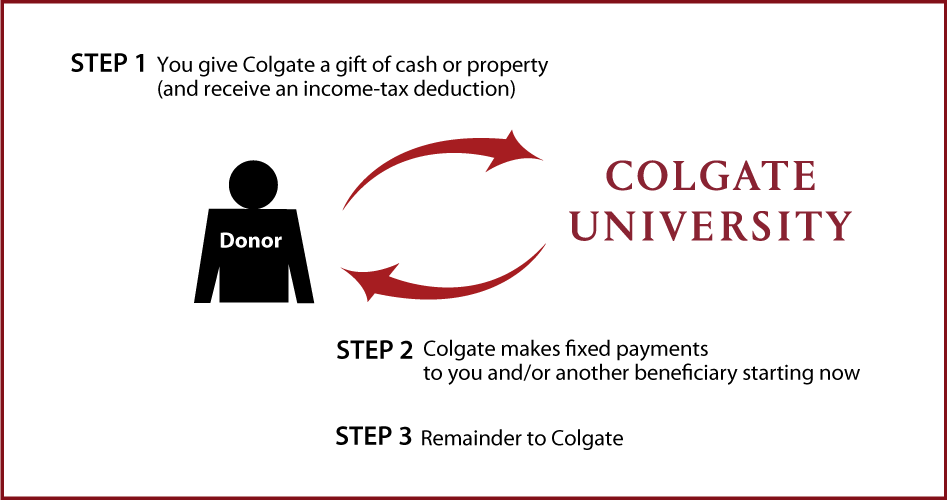

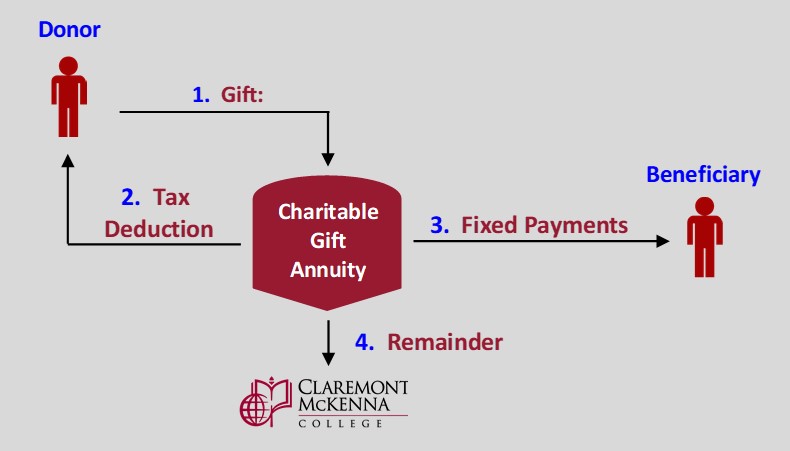

The Cmc Charitable Gift Annuity Claremont Mckenna College

Gifts That Pay You Income Fred Hutchinson Cancer Research Center

Gifts That Provide Income Giving To Mit

Charitable Gift Annuity Smith College

Annuity Annuity Life Insurance Marketing Marketing Humor

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuities Uses Selling Regulations

Gifts That Pay You Income The Salvation Army Western Territory Arc

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuities Kqed

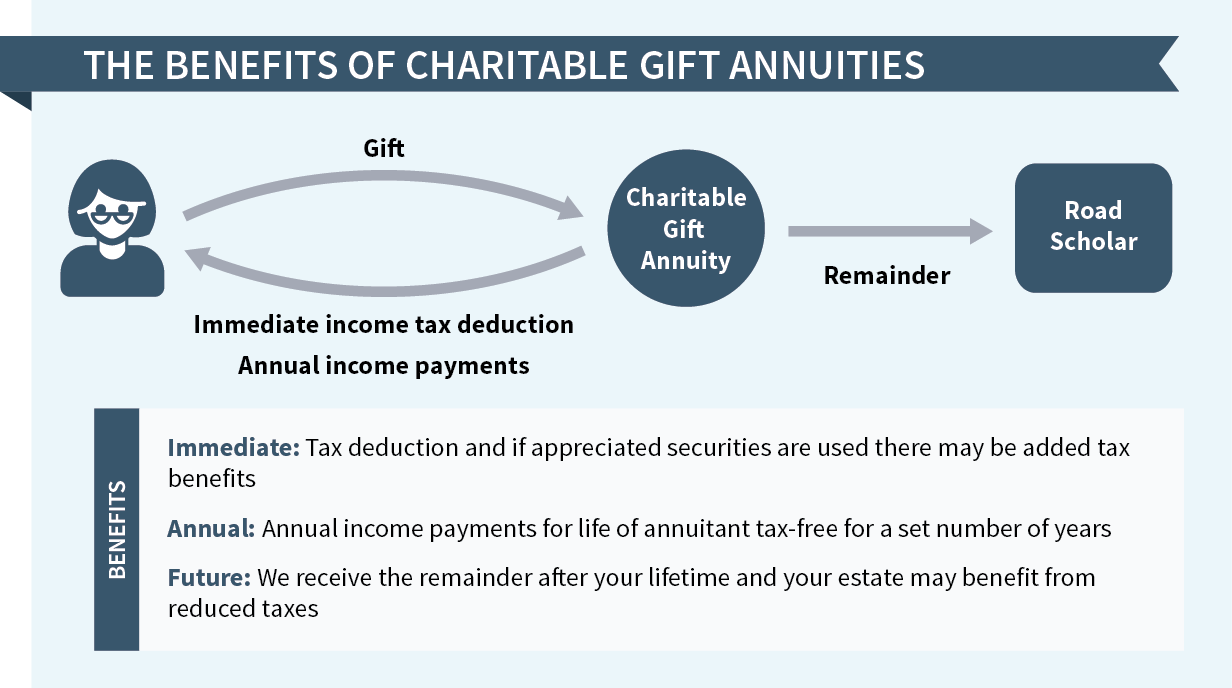

Charitable Gift Annuities Road Scholar

Charitable Remainder Annuity Trusts Giving To Stanford

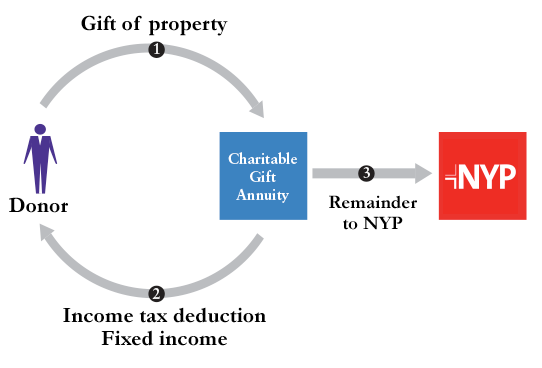

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp

Charitable Gift Annuities University Of Montana Foundation University Of Montana